Can’t Afford A Home On Your Own? Here’s A Thought.

Today’s real estate prices are making it hard enough to purchase property with two salaries, let alone one. Not only that, now, you have to qualify for housing at a new stress test level. So, if you can afford a home, it’s probably a lot less than you could have afforded a year or two ago.

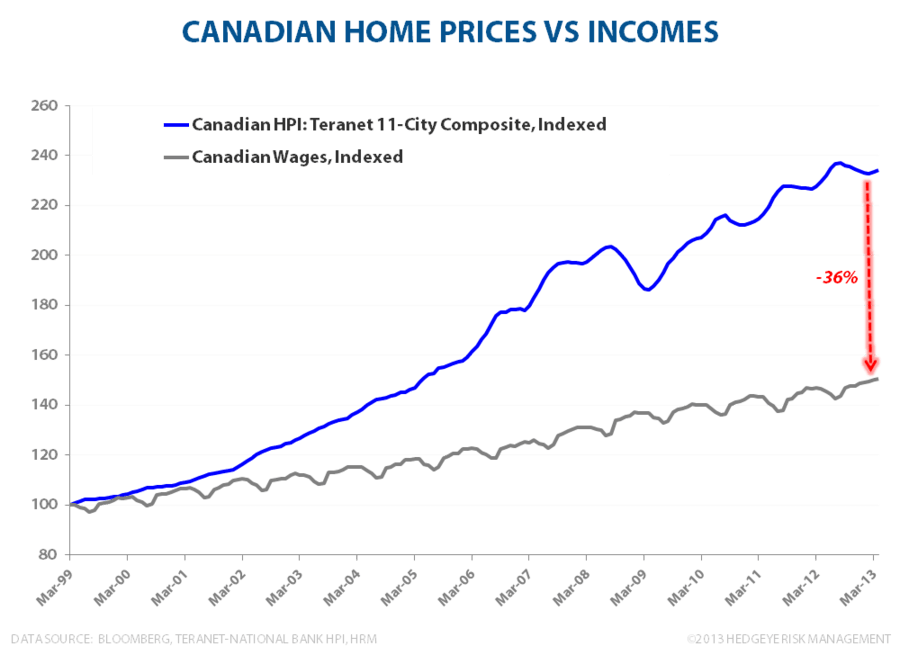

(This image should be speaking volumes to you. Of course you cannot afford a house on your own! How could you? Our wages have not kept up with housing prices since 2002.)

So how do you afford a home if you are single in today’s market?

Your reality is probably that you cannot afford a home on your own.

So what do people do now? In many cases, it’s called co-living. People are buying homes by partnering with a friend or relative. In some extreme cases people are buying home with strangers through meeting online.

Here are just a few articles talking about buying property with other people:

Would you buy a house with a stranger toronto real estate speed dating a new option

In search of a stranger to share a home purchase

Will co-living impact real estate

Can’t afford a home? Buy with a friend or maybe even a stranger

How Do You Get Started?

The first step in entering into what is likely the largest purchase of your life is to sit down with your co-buyer and have a completely honest discussion. This is a no holds barred conversation. The conversation has to be a clear picture about what each of your wants and needs, your expectations and your finances are.

It would be wise to draft up a list of questions together, then go your separate ways to complete the “survey” before getting back together to compare answers.

Here are some questions you may want to start with:

- House, condo, townhouse why?

- Location and amenities that are most important to each of you. Rate these on a scale of most important to least important. Include things such as transit, access to freeways and commute to work.

- Ideal home size including square footage, number of bedrooms and bathrooms.

- Short-term versus long-term goals? Family, work, home.

- Are you buying this property as an investment to be flipped after a set period of time? A short-term housing solution until you can afford your own dwelling? Or longer term home assuming all is going well with your cohabitor?

What Comes Next?

If the conversation goes well and there is a meeting of minds on how to move forward with housing, repairs, living and space utilization then by all means you should begin to look into the legal and financial side of the business transaction.

The financial end of the agreement is a whole separate conversation. This conversation starts with a completely honest disclosure of each of your salaries, credit scores, current debts and financial obligations.

If you find this part of the process hard. If you are unwilling to be honest or if you feel the other party is not being 100%, it might be wise to end conversations here.

However, if your conversations are transparent, open and free flowing you can move on to the next steps of the business transaction.

Make sure you agree on financial points that would include:

- Expected purchase price of the property.

- Down payment. Who can afford what? (And the percentage of the house you will each own).

- Lawyer’s fees and closing costs. (If one party takes more of this, the other party will need to understand when the house sells, this may be taken out of their return

- How will you be splitting the cost of the mortgage and expenses 50/50, or if there’s another ratio you’ll be following. (Again, this is all put pen to paper and returns are adjusted accordingly).

- Expected costs of running a home, from the costs of buying the property (closing costs, legal fees, etc.) to property taxes, utilities and maintenance. Also, contingency funds. How much is put away in case of emergency. These will happen and knowing how much is in the coffers to handle repairs will make the conversation easier when the emergency happens.

- When the day comes that one of you wants to pull out of the agreement, you’ll need to talk about how to agree upon a fair ownership split, and the right of first refusal from the remaining owner.

- This is going to be a hard conversation. Life changes. One party may meet someone. There could be children entering the home, etc. Whatever the situation and circumstance – just be clear on what the outcome will be if the other party is not able to buy out the other party.

Purchasing The Home Together?

The above process and questions should be viewed as a stepping stone to purchasing a home with a friend, family member or stranger. If it still sounds like a good idea to you, or something you are entertaining you will want to work with a realtor and a lawyer to make this plan come to fruition.

Be prepared to ask lots of questions and take a lot of notes.

Be sure to be pre-approved for a mortgage so you know exactly what you can afford. A lawyer will be crucial in this process to draft up a cohabitation agreement. This will clarify and highlight the type of agreement you have, complete with financial obligations.

As always, if you are thinking about purchasing or selling a home we would love to help you. It’s an interesting time to be involved in real estate and we’d love to help you navigate the process.