Fall is coming. This often activates the urge to want a change… as it’s in the air. It also makes some people want to pack up and leave!

Before you decided to make a move, to move, let’s refresh some home-buying basics.

Down Payments:

Some people do not know how down payments are calculated. No worries if you are one of them!

Let’s jump in.

To buy a house in Canada, your minimum down payment depends on the home’s purchase price:

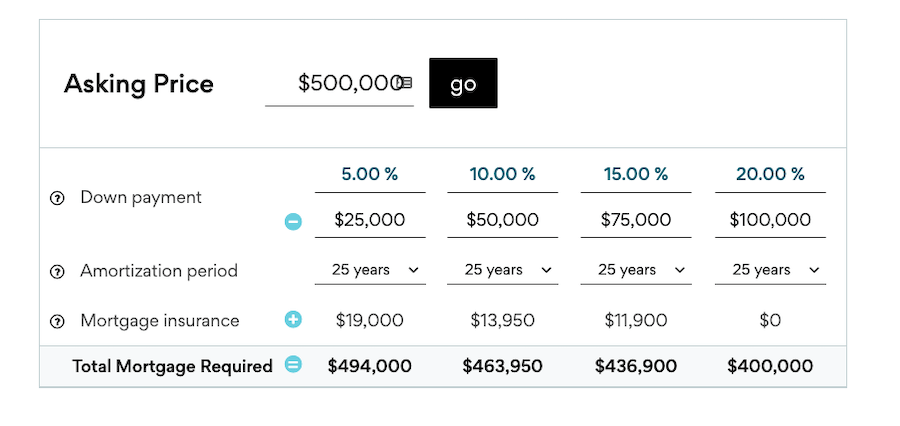

– If the home you want costs $500,000 or less, you’ll need a minimum down payment of 5 percent.

– If the home costs between $500,001 and $999,999, you’ll need 5 percent of the first $500,000 of the purchase price, and then 10 percent for the portion of the purchase price over $500,000.

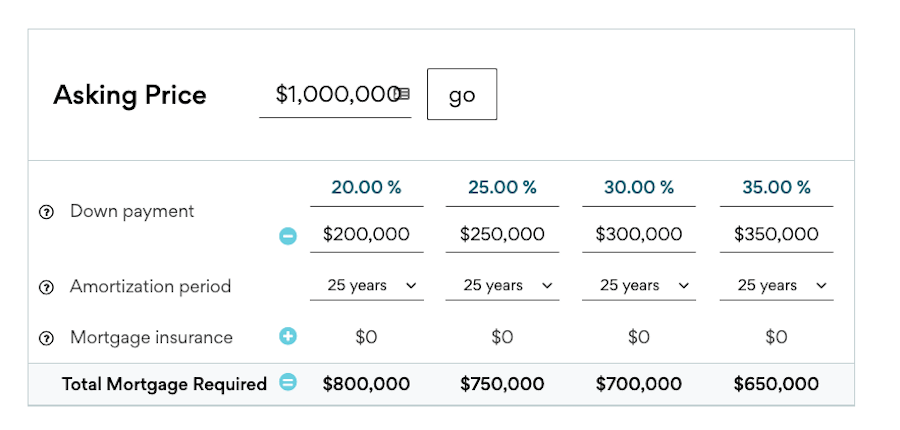

– If the home costs $1 million or more, you’ll need a minimum down payment of 20 percent of the purchase price.

– Note that if you’re self-employed or have poor credit history, you may be required to provide an even larger down payment.

This Is What A Down Payment Looks Likes:

The size of your down payment influences three things

The amount you put down at the beginning of your mortgage shapes three important outputs over the life of the mortgage:

- The home price you can afford

- The size of your mortgage and monthly payment

- The amount of CMHC insurance you pay

As a current homeowner, you may have built up enough equity to allow you to put down more than 20 percent on your next home. But should you?

How Much Should You Put Down

How Much Should You Put Down?

While there are many excellent reasons to put as much money towards your new house as you can, you also don’t want to leave yourself “house poor,” with little to no discretionary income once you move in.

As always if you need help buying or selling your home let us help you.

Gregg Bamford and Ryan Bamford