The Saskatoon market is “sort of” on the upswing. According to the CBoC, after posting 2.0% GDP growth in 2018, the region is forecast to grow by 2.3% by the end of 2019.

Saskatoon’s market for new homes remains slightly oversupplied, leaving builders still cautious after significant declines in starts in 2015 and 2016. The amount of construction will likely decrease again be the end of this year. In the city’s industrial market, rental activity is picking up after landlords acknowledged that current conditions demand lower net effective rental rates to attract and hold onto tenants.

So here are our top 3 predictions for the this fall:

1) Low Interest Rates

It is probably one of the best times to get into a mortgage. Interest rates are low and it does not look like they will be bouncing back up anytime soon. If you are in the market for a new home and mortgage, now is the time to shop around for one.

The market is healthy enough to withstand a rate increases that is in line with the recovery. However, rates haven’t risen nearly as much as many predicted.

If you recall, the government also eased up a bit on the stress test this year.

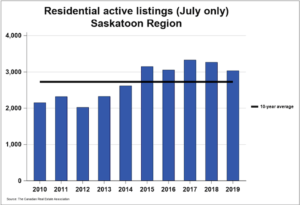

2) More Supply Less Demand

It’s no secret: inventory levels have been the one factor preventing the housing market from realizing its full potential as a sellers market. There simply are enough homes to keep up with demand. There are currently a lot of active listings.

Photo credit: http://creastats.crea.ca/sask/

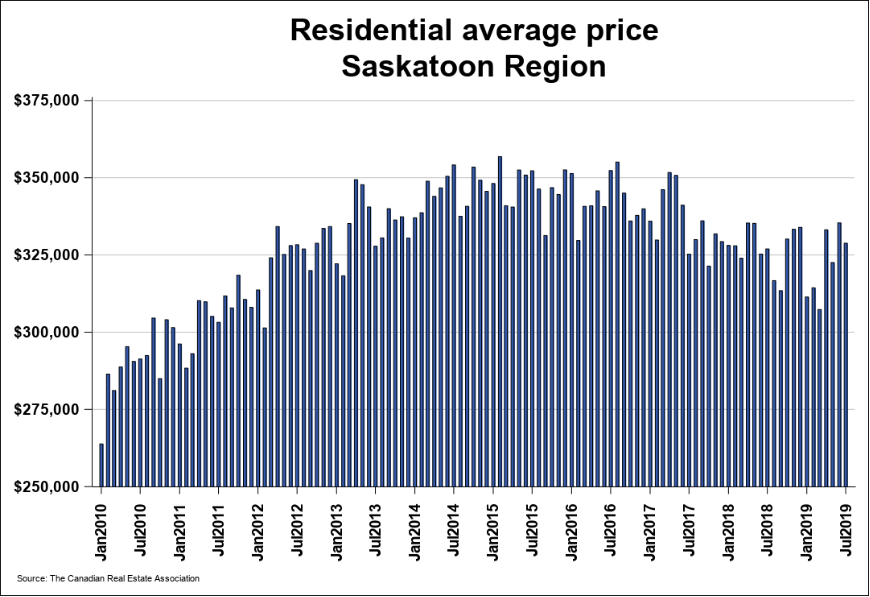

3) Lower Home Prices

Some people think we are going to see a spike in home prices and activity this fall. They could be right.

However, with the amount of homes on the market, the current looming recession and more supply hitting the market, we feel home prices will come down slightly.

A little prelude to that: If your home is on the market, priced accordingly and in great shape for a sale, chances are, you will still be able to sell at asking price.

Photo credit: http://creastats.crea.ca/sask/

So what should you do?

Stay Ahead Of The Competition

The fall real estate season has become synonymous with the tapering off of summer trends. In other words, fall is when we typically see the market start to slow down, but this year may be an exception to the rule. This fall might be busier than normal because of lower prices, lightening stress tests and of course more inventory.

As always, if you need help buying or selling