People have been asking us how to plan to be homeowners. While we are not sure anyone needs to plan how to be a homeowner, there is one thing we know with 100% certainty – you need to have a budget.

Buying a home without having a clear understanding of your personal finances is what gets most people into trouble.

As we are realtors and not in finance the information below is borrowed from: The Credit Counseling Society. They have great information about how to put your finances in order and keep them that way.

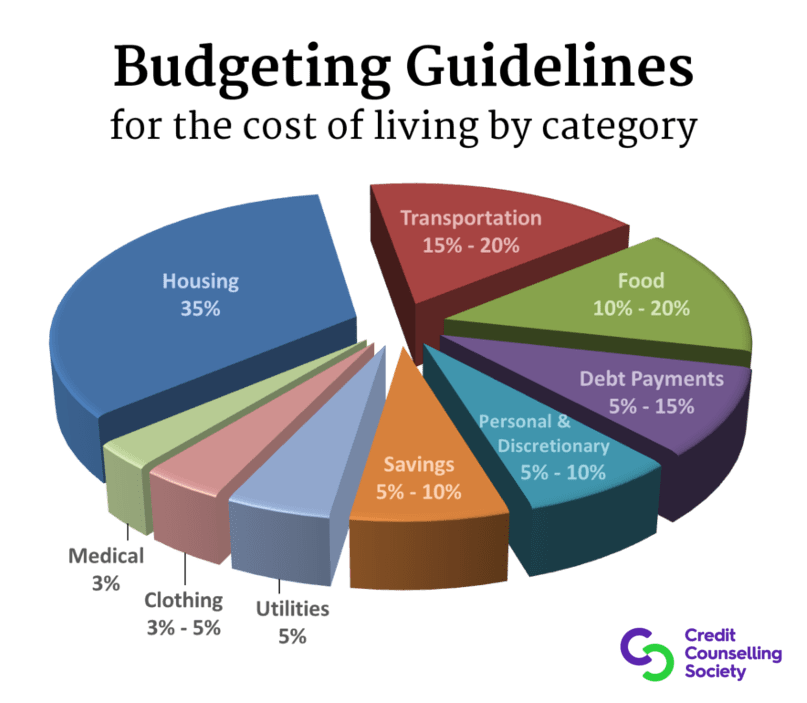

Breakdown of Cost of Living Budgeting Categories

** We are going to use a household income of $4875 (after tax dollars) to go through this exercise.

The Median Household After-Tax Income in Saskatoon is $58,581.50.

-

Housing: 35% ($1700.00)

mortgage / taxes / strata / rent/ insurance / hydro /- All of the household expenses need to fall under this category. So, if your household income is $4875 (after tax dollars) your bills cannot go over $1706.20 per month. If you are over in this category, chances are you are going to be going over in other areas. Thus, starts the vicious cycle of living outside your means. Don’t believe us, wait until the end, you will see what we mean!

-

Utilities: 5% ($243.00)

phone / cell phone / gas / cable / internet

- Utilities should not make up more than 5% of all of your income. So, if your monthly income is $4875 – these bills cannot add up to more than $243.00. This needs to include all cell bills, and cable and internet. So, add up your cell bills, cable, internet, satellite, Netflix, gas, H20 etc.. If you are not around the 5% mark, you will need to adjust.

-

Food: 10 – 20% ($731.00)

groceries / personal care / baby needs

- Many people go over in this category. Eating out is a lot more expensive than eating at home. Whenever you eat out, you need to add those expenses here. $731.00 on food is about $160 per week, or about $20.00 per day. Now, if you have a family of 3 or 4 – feeding people on $20.00 a day is not realistic if you are always eating out.

-

Transportation: 15 – 20% ($975.00)

bus / taxi / fuel / insurance / maintenance / parking

- This is a big one. Many people purchase vehicles they cannot afford. If you need two cars – both need to be around $300 in payments per month so that you can afford the gas, maintenance and insurance. You also need to include maintenance (if anything goes wrong) and parking here.

-

Clothing: 3 – 5% ($146.00)

for all members of the family

- A lot of families suffer in this department. It is hard to cloth a family of 3 or 4 on $146 dollars per month. Most families tend to go over in this department as running shoes cost more than that. $1752 on a clothing allowance (per year) does not allow a lot of wiggle room.

-

Medical: 3% ($146.00)

health care premiums / specialists / over-the-counter

- Being in Canada we are very fortunate to have most of our medical expenses covered for us. However, there is the odd time that you will need to pay out of pocket for medical treatment. We suggest people put away 3% of their income to cover this. This also equals $142 per month or $1752 per year.

-

Personal & Discretionary: 5 – 10% ($487.00)

entertainment / recreation / education / tobacco/ alcohol / gaming / hair cuts / hobbies / sports / vacations

- Many people take a few vacations per year. Many of us feel jealous when we see our friends living it up on the beach and suntanning. However, having $487 per month for a vacation equals $5844 for the year. Knowing this, It should become clear that you will need to save up for family vacations and taking multiple locations per year is not a reality.

-

Savings: 5 – 10% ($487.00)

Plan to save money for expenses that don’t occur every month, as well as for your future. RRSPs / RESPS / Tax Free Savings / housing maintenance

- $487 or $5844 for the year in savings is not a lot. It’s great if people can save closer to 20% for savings per year. In order to qualify for the RESP matching the government supports with education parents need to put aside $210 per month per child. If you have two children – that’s $420 per month meaning – there is no more money for your personal savings.

- We would also like to stat this is the most important category! Everyone needs to have savings in case of: rainy days, disability, death, sick children, loss of job, etc. Most people who do not have a savings plan start spiralling quickly when there is nothing to fall back on.

- $487 or $5844 for the year in savings is not a lot. It’s great if people can save closer to 20% for savings per year. In order to qualify for the RESP matching the government supports with education parents need to put aside $210 per month per child. If you have two children – that’s $420 per month meaning – there is no more money for your personal savings.

-

Debt Payments: 5 – 15% ($731)

Many people find that their budget is quite tight when their monthly debt payments are close to 23% of their net income. Please note, it is almost impossible to climb yourself out of debt if you need 23% of income to be allocated towards it.

- In order to actually pay down debt and save for the future and ensure you have a break in life – putting away 20% for debt repayment is necessary. However, for this exercise we are going to keep this at 15% which means $731 per month needs to be put towards your debt. This includes:

- Credit card debt

- Student loan debt

- Past foolish spending debt (Consumer debt)

- Using your visa as a bank and paying off cash advances

- In order to actually pay down debt and save for the future and ensure you have a break in life – putting away 20% for debt repayment is necessary. However, for this exercise we are going to keep this at 15% which means $731 per month needs to be put towards your debt. This includes:

Now, if you go back up above and try to make this budget work you will see quickly, it doesn’t!

What you will find is that you need $5646 a month to afford everything above. Seeing that the household income is about $4875 people are going $771 dollars per month in debt – attempting to stick to a budget. A budget that is already pretty lean. Now, imagine people who do not budget – or those that spend $12,000 on family vacations per year. You can see why homeownership becomes questionable for some people.

To sum up – Budgeting to be a homeowner and affording your future requires some sacrifices in life. However, the payoff is great in the end.

Please remember, we are not accountants, we are realtors and this information was borrowed from The Credit Counseling Society. If you are having problems with finances, they are great people to work with.

If you need help buying or selling your property – please contact Gregg Bamford or Ryan Bamford.