A lot has changed in 2022 with regards to housing. And there are many more changes on the way.

Most of Canada’s big banks are now advertising special-offer 5-year fixed rates above 4%. Those big banks are RBC, TD, BMO, CIBC and National Bank of Canada. That’s not all – many other mortgage lenders are following suite.

Insured 5-year fixed rates are now averaging 3.98%. Uninsured mortgages are averaging 4.12%. Many people are now opting to switch from the variable interest rates to fixed interest rates as well. The increase is up about 25 basis points since the start of April. There are going to be a lot more changes coming soon as well.

The rapid rise of fixed interest rates seen to date, and further increases to variable rates expected in the coming months is going to have Canada’s housing market feeling these effects very soon.

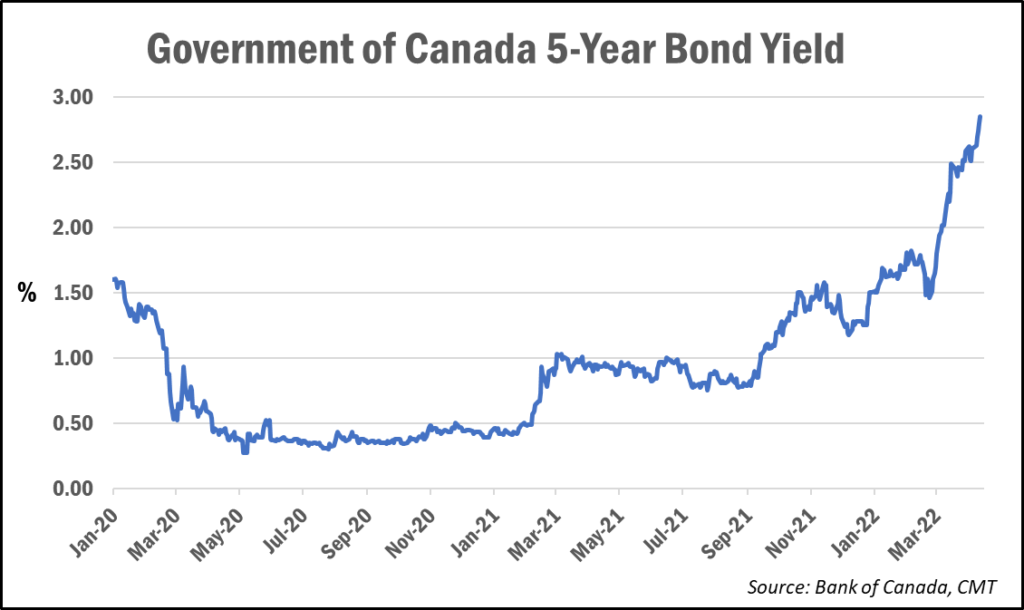

The interest rate hike follows the latest leg-up in the Government of Canada 5-year bond yield. For those who do not know – this was at an all time 11-year high of 2.80% last week on higher-than-expected inflation data.

While some people think the interest hikes are not great for real estate there are others who disagree.

Not everyone is viewing the interest rates as a major threat to housing. There are many that think rising interest rates are likely to bring welcome changes to the market. One thought process is that the rising interest rate might bring more sustainable activity to the housing market.

There may also be fewer price wars as less people will be able to qualify for larger housing. Last but not least, the interest rates might bring a more balanced condition and modest price relief for buyers.

While all of this is great news for sellers, buyers may have a slightly different feeling about the market depending on when they purchased their home.